Disclaimer: This piece is written purely in a light vein, with malice toward none—whether bureaucrats or political personalities, living or dead. We apologise in advance for any inconvenience caused to anyone, including (and especially) the Indian rupee.

Disclaimer: This piece is written purely in a light vein, with malice toward none—whether bureaucrats or political personalities, living or dead. We apologise in advance for any inconvenience caused to anyone, including (and especially) the Indian rupee.

🇮🇳 ₹@90

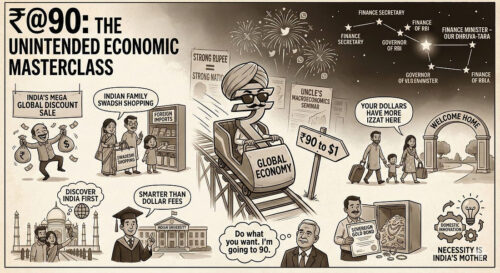

There are moments in a nation’s economic journey when the rupee looks at the dollar, takes a deep breath, fixes its metaphorical turban, and declares, “I’m going to 90. Do what you want.” Today was one such moment, as the Indian rupee finally breached the emotional, over-analysed, meme-drenched barrier of ₹90 to a US dollar.

Predictably, the political and digital fireworks began. Opposition leaders dusted off old speeches of the Chief Minister of Gujarat, thundering that a strong rupee equals a strong nation. Twitter (or X, for those still adjusting to the rebranding) exploded with spoofs. WhatsApp groups instantly converted into PhD-level seminars on macroeconomics—moderated, of course, by that one uncle who forwards every RBI screenshot he sees.

But hidden in the din of outrage and nostalgia is a spectacularly ironic possibility: this could be a masterstroke. A slow-cooked, bureaucratically marinated, seven-layered strategy engineered—consciously or otherwise—by the high priests of policy in North Block and Mint Street.

So, with tongue firmly in cheek and a smile on our faces, let us examine seven “good” reasons why ₹90 to the dollar might actually be the greatest economic masterclass since India discovered UPI.

1. Exporters Are Dancing: India’s Mega Global Discount Sale Has Begun

Let us start with the group that is secretly the happiest today: exporters.

A weaker rupee means Indian goods and services have just become irresistibly cheap abroad. That German auto-parts importer staring at his spreadsheet this morning probably thought his software had a bug when he saw how much more he could order for the same euros. The Japanese buyer of Indian pharmaceuticals may well be considering a bonus for himself.

From textiles and auto components to software services, bulk drugs, business-process outsourcing, and tourism packages—India has effectively put up a giant flashing sign in the global bazaar:

“WELCOME TO THE GREAT INDIAN DISCOUNT SEASON – EVERYTHING (LEGAL) MUST GO!”

Our exports look more competitive, trade deficits may shrink, and somewhere in a boardroom, an exporter is whispering:

“Rupee at 90? Chalo, not bad.”

2. Farewell to Mindless Imports: Swadeshi Shopping Gets a Currency-Powered Push

Indians love imported stuff with a passion bordering on poetic. Swiss chocolates, Korean skincare, Japanese toilets, Italian tiles—if it crossed an ocean, we wanted it in our drawing room.

But with the rupee at 90, this enthusiasm is about to undergo a reality check. That imported phone, that foreign luxury bag, that fancy cheese—everything suddenly costs just enough more to make you pause and say: “Maybe… not this month.”

In a way, the rupee has become your grandmother:

“Why buy foreign when Indian is good enough—and cheaper? Eat local, wear local, live local!”

And to be fair, Indian products have levelled up. Our cars run smoothly, our electronics behave, our textiles charm the world, and our FMCG sector knows how to please even the pickiest consumer.

The rupee’s fall may hurt your imported coffee habit. But it might also revive a quiet, durable swadeshi-consumer revolution.

3. Discover India: Why Pose at Big Ben Before You’ve Seen the North-East?

For years, the Indian middle class has treated foreign holidays as a civilisational duty. London, Paris, Bangkok, Dubai—our passports were busier than our MPs during a no-confidence motion.

Now, however, with the rupee at 90, foreign travel costs resemble the defence budget of small countries. Airfares plus hotels plus meals plus shopping: suddenly, that Europe trip looks like a hostile takeover of your savings.

Enter the new mantra: Discover India First.

Why stand in line at the Eiffel Tower when Hampi’s ruins stand in silent grandeur?

Why trek the Alps when the Himalayas offer higher peaks and better chai?

Why chase sunsets in Santorini when the Andamans and Goa are right here?

From Meghalaya’s living root bridges and Ladakh’s moonscapes to Kerala’s backwaters and the deserts of Rajasthan, India is bursting with destinations that are stunning, soulful, and now significantly cheaper than Paris.

If the rupee’s fall keeps us within our borders, it may also make us fall in love with our own country again.

4. Indian Universities Suddenly Look Much Smarter Than Their Dollar Fees Abroad

For decades, sending your child to the US or UK was the ultimate status symbol. Never mind the course, never mind the debt—as long as there was snow in the background of the graduation photo, all was well.

But with the rupee now at 90, foreign education has become a very expensive way to learn basic economics. Tuition fees, living costs, health insurance, and the unpredictable nature of F-1, F-2, and H-1B visas have collectively turned the “American Dream” into a very complicated spreadsheet.

Meanwhile, India’s top public and private universities are quietly thriving—with strong faculty, serious research, international tie-ups, and campuses that now resemble global institutions rather than overgrown coaching centres.

Why not save crores, keep your child within striking distance, and avoid late-night panic about visa lotteries?

The rupee at 90 might finally push us to recognise that good education need not require a foreign pin code.

5. NRIs Will Bring Their Dollars Home—and We Don’t Want Them to Feel Cheated

India’s relationship with its Non-Resident Indians is emotional and financial in equal measure. We send them wedding invitations; they send us remittances. They buy property here; we WhatsApp them photos of every family function they missed.

But increasingly, many Indians abroad are finding it harder to stay permanently in America and elsewhere—thanks to tightening H-1B norms, uncertain green-card timelines, and shifting immigration moods. A slow but steady reversal may well be underway.

When they do bring their savings home, a strong dollar is the best “Welcome Back” banner we can offer. One dollar now fetches ninety rupees—a warm, generous, macroeconomic hug.

They may not all invest wisely (or at all), but at least they will not feel short-changed. In a way, the rupee at 90 is our way of saying:

“Come home, beta. Your dollars have more izzat here.”

6. Gold & Gold Bonds: From Jewellery Boxes to Silent Strategic Arsenal

Now to our favourite national hobby: gold.

India is not just a country; it is a vast, decentralised gold vault. Our homes and temples store unimaginable quantities of the yellow metal, acquired one bangle, one necklace, one wedding set at a time. With global gold prices at record highs in dollar terms, this mountain of metal has never been more valuable.

And at Align, somewhere we must also applaud a very special class of patriots—those who invested in Sovereign Gold Bonds (SGBs). While others bought jewellery for “sentimental reasons,” these calm, spreadsheet-loving citizens bought digital gold that earns annual interest and avoids making the bank locker groan.

Today, as the rupee slides and gold soars, SGB holders are the quiet winners. Their wealth rises without them having to polish a single ornament. If needed, India can tap both emotional gold (jewellery) and financial gold (SGBs) as a strategic buffer.

Who needs panic about forex when your country’s aunties and SGB investors combined could probably stabilise half of South Asia?

7. Domestic Innovation Will Surge—Because Necessity Is India’s Favourite Mother

Finally, the long-term upside: innovation.

When imports become painfully expensive, nations either sulk or innovate. India, traditionally, does both—but we tend to innovate better.

A costly dollar is a nudge to:

build more indigenous hardware and chips,

strengthen the EV, battery, and renewables ecosystem,

boost defence manufacturing,

expand AI, robotics, and deep-tech start-ups,

and reduce dependence on global supply chains for critical technologies.

The rupee may have dropped to 90, but if it pushes us towards self-reliance in high-tech and manufacturing, history may remember this as the slightly painful nudge that forced India to level up.

Image

⭐ The New Economic Constellation: Saptarishis and the Pole Star

A performance this intricate surely cannot be left to market forces alone. It demands a cast. Enter the newly anointed Saptarishis of the Indian Economy:

The Finance Secretary – Guardian of fiscal dharma and red files.

The Expenditure Secretary – Relentless warrior against “unnecessary” spending (a flexible term).

The Economic Affairs Secretary – Keeper of the exchange-rate scriptures and bond-market moods.

The Revenue Secretary – Harvester of taxes and sworn nemesis of creative accounting.

The Governor of the RBI – The stoic yogi of Mint Street, who can move markets with a single carefully chosen adjective.

The Chief Economic Advisor – Scholar of metaphors and master of charts thick enough to be used as door-stoppers.

The Chairman, PM’s Economic Advisory Council – Long-term oracle of growth, demographics, and destiny.

And above them all, anchoring this economic galaxy, shines the Pole Star.

⭐ The Finance Minister: Our Dhruva-Tara of Fiscal Space

Every constellation needs a fixed point—its Dhruva-Tara. In our economic sky, that role belongs to the Finance Minister of India.

It is she who stands steady at the centre, delivering marathon budget speeches, balancing political promises with fiscal arithmetic, and providing orientation to the Saptarishis as they orbit around her in disciplined, bureaucratic elegance.

While the rupee travels to 90 and beyond, her calm presence reassures the markets that someone, somewhere, is reading all the footnotes.

So here we are:

One Pole Star. Seven Rishis. Ninety rupees to the dollar.

The rupee may have fallen, but as a nation, we have certainly risen—if not in purchasing power, at least in our capacity to turn economic anxiety into satire, reflection, and, just possibly, opportunity.

e